Capacity Market

Livro sobre "Capacity Market" publicado em 2015.

Explica os vários Capacities Markets na Europa.

Leigh Hancher, Adrien de Hauteclocque, and Małgorzata Sadowska (Editors), “Capacity Mechanisms in the EU Energy Market - Law, Policy, and Economics”, Oxford University Press, 2015.

Why capacity mechanisms?

The missing money problem and RES capacity

In 1996, the EU embarked upon the liberalization of the electricity market. In 2003 and 2009, two waves of legislation followed, and 2014 was declared the year of completion of the internal energy market. …[] a process of spontaneous convergence has led all Member States to adopt a pool market model for wholesale trading.

In the pool, producers and importers sell their output through a bidding process to suppliers, traders, and large industrial customers. Bids are arranged in ascending order, according to the marginal costs of generating units (the so-called ‘merit order’), and the price is set at the level of the marginal cost of the most expensive unit dispatched in order to meet demand. However, this model—which is often described as the ‘energy only’ market - suffers from a notable failure: demand and supply do not necessarily meet at times of extreme scarcity, ie there is no guarantee of the market clearing. Two factors commonly explain this failure.

First, demand is inflexible. In other commodities markets, if supply is scarce, the price would rise and demand would shrink until the market clears. By contrast, in electricity markets, customers are often unable to reduce demand. As a consequence, there may be situations where, even if all available generators produce as much electricity as they can, they are still unable to meet demand. This leads to energy rationing (rolling blackouts). Because supply and demand do not meet, the market does not send any meaningful price signal at times of extreme scarcity.

Second, prices may be capped. Assuming there is enough capacity to meet demand even at peak times, the energy price will rise to reflect the marginal operating cost of the most expensive unit dispatched. When the margin between available capacity and peak demand tightens, electricity prices will rise to the point of reflecting a scarcity premium. Prices may then reach extremely high values, potentially up to the value of lost load (VOLL), when consumers prefer not to consume energy. For reasons of socio-political acceptability and functioning of the energy-only market, prices may be capped. In these cases, supply will meet demand (in the short term), but the capped price might not be enough to cover the fixed costs of the producing power plants, which in turn may deprive the market of the necessary investment in new or replacement capacity.

Thus, the energy-only market may not provide the price signal which would guarantee an adequate level of generation. This situation is commonly described as the missing money problem, because of the failure to provide high enough returns to maintain the level of capacity adequate to meet demand. Capacity mechanisms address this failure by providing the payments deemed necessary to support an appropriate level of generation adequacy, in addition to the revenues from the energy-only market. Against this background, the integration of large stocks of capacity from renewable generation sources (RES) contributes to the generation adequacy problem in two ways. First, RES capacity exacerbates the traditional missing money problem. Second, RES capacity contributes to another market failure. These two points are discussed in the two following paragraphs.

First of all, RES production is characterized by very low marginal costs and when it sets the price in the energy-only market, the price level may reach zero or a level close to zero. As a result, all other generators are unable to cover their costs. When demand is met by RES capacity acting together with other technologies, the result is that the supply curve moves to the right (see Figure 1.1). Some conventional plants are therefore pushed out of the merit order and all suffer from low utilization rates. As a result, there is a strong incentive for them to exit the market.

In conclusion, for the foregoing reasons, in systems characterized by the presence of a large amount of RES, capacity mechanisms are considered to address at least two market failures. The first is the traditional ‘missing money’ problem, where the energy-only market may not provide sufficient revenues to justify investments that would guarantee the desired level of generation adequacy. The second is the need for enough flexible capacity to act as a back-up for RES electricity generation. Capacity mechanisms thus bridge the gap between both environmental and security of supply.

Leigh Hancher, Adrien de Hauteclocque, and Małgorzata Sadowska (Editors),

“Capacity Mechanisms in the EU Energy Market - Law, Policy, and Economics”,

Oxford University Press, 2015.

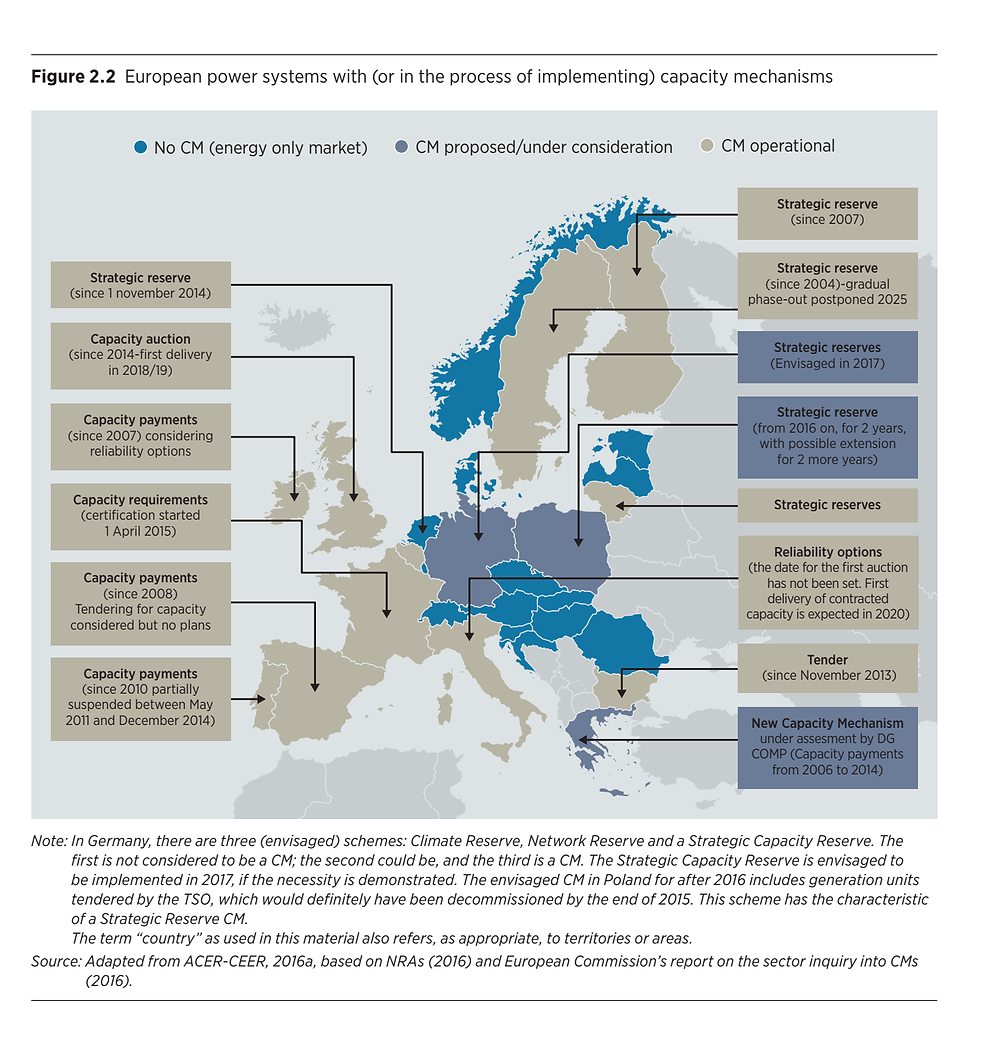

European Power systems with (or in the process of implementing) Capacity Mechanisms

IRENA (2017), Adapting market design to high shares of variable renewable energy.

Reforming capacity markets to meet clean energy goals and support the grid of the future

This week, the Federal Energy Regulatory Commission (FERC) kicks off a series of technical conferences on "Modernizing Electricity Market Design" with an examination of the role of centralized capacity markets in meeting resource adequacy and reliability needs in a rapidly changing electricity sector. This national conversation comes as the future of the PJM Interconnection (PJM), ISO New England (ISO-NE), and New York Independent System Operator (NYISO) capacity markets are also the subject of investigations by state regulators as well as internal stakeholder debate.

By Jeff Dennis, https://www.utilitydive.com/news/reforming-capacity-markets-to-meet-clean-energy-goals-and-support-the-grid/597069/, Published March 22, 2021.

MISO capacity prices plunge over 93% as generation comes online, demand dips in first seasonal auction

Published May 19, 2023

Senior Reporter

In the Midcontinent Independent System Operator’s first-ever seasonal planning resource auction, or PRA, capacity prices plunged to a range of $2/MW-day to $15/MW-day from $236.66/MW-day a year ago across the grid operator’s central and northern regions, driven by new power supplies and a dip in expected electricity demand. The PRA results mark a sharp turnaround from last year’s auction when prices soared and MISO warned of possible rolling blackouts. This year, MISO had enough capacity across its footprint, in its two subregions, and in each of its 10 zones. In a major change, MISO is no longer holding its annual, voluntary PRA, the equivalent of a capacity auction, to meet peak summer load. Finding that grid emergencies are occurring throughout the year, it has shifted to meeting capacity needs for each season. For almost all MISO’s footprint, capacity prices were $10/MW-day in the summer, $15/MW-day in the fall, $2/MW-day in the winter, and $10/MW-day in the spring. The fall and winter prices in MISO’s zone 9, which includes parts of Louisiana and Texas, were $59/MW-day in the fall and $19/MW-day in the winter, respectively. Market participants delayed power plant retirements and made additional existing capacity available to the region, helping bolster MISO’s capacity supplies, according to the grid operator.

Local Balancing Authority (LBA) shall mean the responsible entity that integrates resource plans ahead of time, maintains load-interchange-generation balance within a balancing authority area, and supports interconnection frequency in real time

(https://www.lawinsider.com/dictionary/local-balancing-authority#:~:text=Local%20Balancing%20Authority%20.,interconnection%20frequency%20in%20real%20time)

How many balancing authorities are in the US?

These entities are often called control area operators, although this term has been replaced by “balancing authority” in North American Electric Reliability Corporation (NERC) terminology. As of 2022, there are 66 balancing authorities in the U.S., eight in Canada, and one in Mexico.

(https://energyknowledgebase.com/topics/balancing-authority.asp#:~:text=These%20entities%20are%20often%20called,Canada%2C%20and%20one%20in%20Mexico.)

Plus Power, a San Francisco-based developer of grid-scale batteries, is building the two largest battery projects to date in the region — a 150-MW/300-MWh lithium-ion battery system at Carver, Mass., south of Boston, called Cranberry Point Energy Storage, and a 175-MW/350-MWh lithium-ion battery system in Gorham, Maine.

....

New England, it appears, is becoming one of these regions. That Plus Power won a piece of the highly competitive regional capacity auction means that battery storage is now able to compete head-to-head economically — without subsidies — against incumbent fossil fuel generation in New England.

Leilão T-3 de Capacity Market no Reino Unido em fevereiro de 2020

Após ter feito uma pequena pesquisa sobre os dois únicos Leilões de Reserva de Capacidade realizados até o momento no Brasil, segue um breve resumo:

1º LEILÃO DE RESERVA DE CAPACIDADE (Data: 21/12/2021)

Leilão de Reserva de Capacidade, de 2021, para Contratação de Potência Elétrica e de Energia Associada, a partir de empreendimentos de geração, novos e existentes, que acrescentem potência elétrica ao Sistema Interligado Nacional – SIN. Portarias do MME que determinaram as diretrizes do Leilão: Portaria nº 20/GM/MME, de 16 de agosto de 2021 - Diretrizes para se realizar o LRC/2021; e Portaria nº 29/GM/MME, de 20 de outubro de 2021 - Sistemática a ser aplicada no LRC/2021.

Que tipo de Geração pôde participar do Leilão? Só empreendimentos termelétricos (gás natural, óleo combustível, óleo diesel e bagaço de cana). Estavam disponíveis para Leilão os seguintes produtos: I - Produto Energia; e II - Produto Potência. Não houve negociação no Produto Energia. No Produto Potência foi totalizado 5.125,773 MW de potência instalada de empreendimentos vencedores, com um preço médio de 824.553,83 R$/MW.ano

Foi necessário apresentar Parecer de Acesso? Conforme § 1º, Art. 14 da Portaria Normativa Nº 20/GM/MME, de 16 de agosto de 2021, ficou dispensada a apresentação do Parecer de Acesso ou documento equivalente quando o Ponto de Conexão do Empreendimento ao SIN se enquadrar como Instalação de Rede Básica, DIT ou ICG.

Qual a ideia básica da Sistemática do Leilão? Conforme Portaria nº 29/GM/MME, de 20 de outubro de 2021, o Leilão do PRODUTO POTÊNCIA foi composto por três Etapas: 1) ETAPA INICIAL; 2) ETAPA CONTÍNUA; e 3) ETAPA DE RATIFICAÇÃO DE LANCES do PRODUTO POTÊNCIA.

A ETAPA INICIAL é a Etapa em que os empreendedores podem submeter um único Lance para que seus empreendimentos possam ser classificados para as próximas etapas do Leilão, por ordem crescente de PREÇO DE LANCE, considerando a CAPACIDADE REMANESCENTE PARA ESCOAMENTO DE GERAÇÃO.

A CAPACIDADE REMANESCENTE PARA ESCOAMENTO DE GERAÇÃO é divulgada pelo ONS antes da realização do Leilão.

Vale ressaltar que, caso os empreendimentos já tivessem celebrado e apresentado, quando da Habilitação Técnica junto à EPE, os CUST e CCT, para o acesso à Rede Básica; ou CUSD e CCD para o acesso aos Sistemas de Distribuição, estes não participariam da ETAPA INICIAL e já iriam ser remetidos diretamente para a ETAPA CONTÍNUA.

2º LEILÃO DE RESERVA DE CAPACIDADE (Data: 30/09/2022)

Leilão de Reserva de Capacidade na forma de Energia, de 2022 - LRCE, destinado a contratar energia de reserva proveniente de novos empreendimentos de geração, de fonte termelétrica a gás natural. Portaria do MME que determinou as diretrizes do Leilão: Portaria Normativa nº 46/GM/MME, de 23 de junho de 2022

Que tipo de Geração pôde participar do Leilão? Só empreendimentos termelétricos a gás natural na modalidade por disponibilidade. Estavam disponíveis para Leilão os seguintes produtos: - Produto Região Norte; II - Produto Região Nordeste Maranhão; e III - Produto Região Nordeste Piauí. Sagraram-se vencedoras 3 termelétricas no Produto Região Norte, totalizando 753,763 MW de potência instalada com um preço médio de 444,00 R$/MWh.

Foi necessário apresentar Parecer de Acesso? Conforme § 1º, Art. 12 da Portaria Normativa nº 46/GM/MME, de 23 de junho de 2022, ficou dispensada a apresentação do Parecer de Acesso ou documento equivalente quando o Ponto de Conexão do Empreendimento ao SIN se enquadrar como Instalação de Rede Básica, DIT ou ICG.

Qual a ideia básica da Sistemática do Leilão? Conforme Portaria nº 46/GM/MME, de 23 de junho de 2022, o Leilão para todos os produtos do certame foi composto por três Etapas: 1) ETAPA INICIAL; 2) ETAPA CONTÍNUA; e 3) ETAPA DE RATIFICAÇÃO DE LANCES.

A ETAPA INICIAL é a etapa que trata da classificação dos EMPREENDIMENTOS e a avaliação concomitante das propostas para todos os PRODUTOS considerando a CAPACIDADE REMANESCENTE DO SIN PARA ESCOAMENTO DE GERAÇÃO, em que os LANCES serão ordenados pelo SISTEMA seguindo ordem crescente de PREÇO DE LANCE de cada EMPREENDIMENTO.

A CAPACIDADE REMANESCENTE PARA ESCOAMENTO DE GERAÇÃO é divulgada pelo ONS antes da realização do Leilão.

Vale ressaltar que, caso os empreendimentos já tivessem celebrado e apresentado, quando da Habilitação Técnica junto à EPE, os CUST e CCT, para o acesso à Rede Básica; ou CUSD e CCD para o acesso aos Sistemas de Distribuição, estes não participariam da ETAPA INICIAL e já iriam ser remetidos diretamente para a ETAPA CONTÍNUA.