O Futuro da Gestão de Risco Financeiro

Kodak’s fate

To a greater extent than other mathematical disciplines, statistics is a product of its time. If Francis Galton, Karl Pearson, Ronald Fisher, and Jerzy Neyman had had access to computers, they may have created an entirely different field. Classical statistics relies on simplistic assumptions (linearity, independence), in-sample analysis, analytical solutions, and asymptotic properties partly because its founders had access to limited computing power. Today, many of these legacy methods continue to be taught at university courses and in professional certification programs, even though computational methods, such as cross-validation, ensemble estimators, regularization, bootstrapping, and Monte Carlo, deliver demonstrably better solutions.

Financial problems pose a particular challenge to those legacy methods, because economic systems exhibit a degree of complexity that is beyond the grasp of classical statistical tools. As a consequence, machine learning (ML) plays an increasingly important role in finance. Only a few years ago, it was rare to find ML applications outside short-term price prediction, trade execution, and setting of credit ratings. Today, it is hard to find a use case where ML is not being deployed in some form. This trend is unlikely to change, as larger data sets, greater computing power, and more efficient algorithms all conspire to unleash a golden age of financial ML. The ML revolution creates opportunities for dynamic firms and challenges for antiquated asset managers.

Firms that resist this revolution will likely share Kodak’s fate.

Marcos M. López de Prado, “Machine Learning for Asset Managers (Elements in Quantitative Finance)”, Publisher: Cambridge University Press, April 30, 2020.

Conforme Michael B. Miller (“Quantitative Financial Risk Management", Wiley Finance Series, 2019)

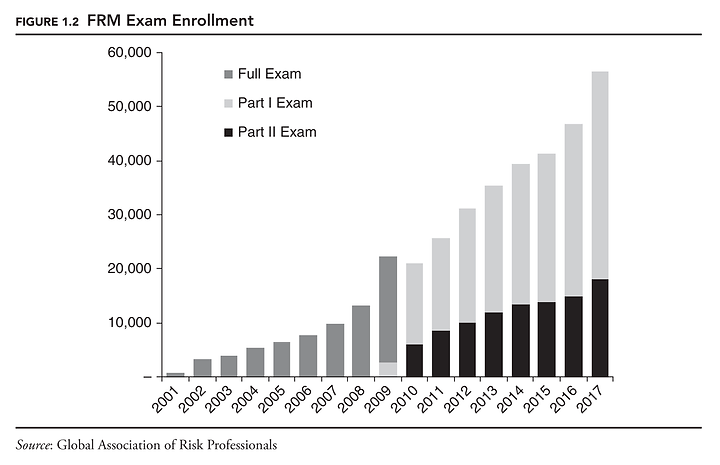

Despite tremendous growth in recent years, financial risk management is still a young discipline. We can expect to see many changes in the roles of financial risk managers in the coming years.

The financial crisis of 2008 called into question some quantitative risk models, but it also caused many to argue for a greater role for risk managers within financial firms. While there were certainly instances when models were used incorrectly, the far greater problem was that the decision makers at large financial firms either never received the data they needed, didn’t understand it, or chose to ignore it. It was not so much that we lacked the tools to properly assess risk, as it was that the tools were not being used or that the people using the tools were not being listened to.

As risk management continues to gain wider acceptance, the role of risk managers in communicating with investors and regulators will continue to grow. We are also likely to see an increasingly integrated approach to risk management and performance analysis, which are now treated as separate activities by most financial firms.

There are still important areas of risk management, such as liquidity risk, where widely accepted models and standards have yet to be developed. If history is any guide, financial markets will continue to grow in breadth, speed, and complexity. Along with this growth will come new challenges for risk managers.

The future of risk management is very bright.

O Futuro das Finanças e da Análise de Risco

Conforme Marcos Lopez de Prado (M. L. de Prado, “Advances in Financial Machine Learning”, 1st Edition, Wiley, 2018):

The algorithmization of finance is unstoppable. The next wave of automation does not involve following rules, but making judgment calls. As emotional beings, subject to fears, hopes, and agendas, humans are not particularly good at making fact-based decisions, particularly when those decisions involve conflicts of interest.

Furthermore, machines will comply with the law, always, when programmed to do so.

Does that mean that there is no space left for human investors? Not at all.

No human is better at chess than a computer. And no computer is better at chess than a human supported by a computer.

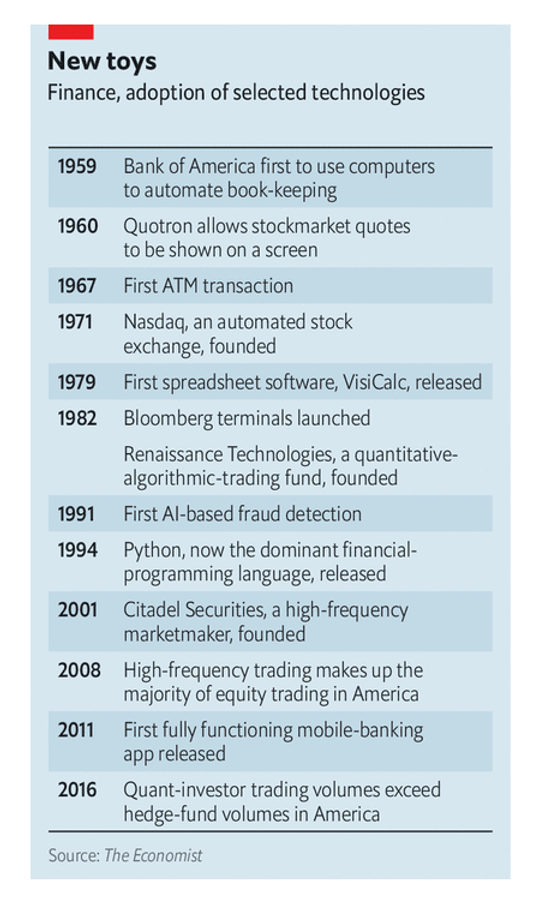

Como exemplos das mudanças tecnológicas que estão acontecendo no mercado financeiro é importante lembrar as “fintechs” e a tecnologia "blockchain".

Atualmente as empresas financeiras estão utilizando a aprendizagem de máquina (Machine Learning) para executar a chamada negociação algorítmica (algorithmic trading), que é mais rápida do que as tradicionais estratégias de investimento de longo prazo e mais cautelosas e ponderadas do que a negociação de alta frequência (High-frequency Trading).

Muitos tipos diferentes de algoritmos de aprendizado de máquina são combinados para formar um sistema híbrido e obter melhores retornos. Na prática, centenas de algoritmos são usados e os melhores são continuamente combinados para otimizar o trade-off risco x retorno (Terrence J. Sejnowski, "The Deep Learning Revolution", MIT Press, 2018).

FIGURA 2 – Algorithmic Trading.

Fonte: (Terrence J. Sejnowski, "The Deep Learning Revolution", MIT Press, 2018).

The Emergence of Quantamental Funds

Two distinct approaches have evolved in active investment management: systematic (or quant) and discretionary investing. Systematic approaches rely on algorithms for a repeatable and data-driven approach to identify investment opportunities across many securities. In contrast, a discretionary approach involves an in-depth analysis of the fundamentals of a smaller number of securities. These two approaches are becoming more similar as fundamental managers take more data science-driven approaches.

Even fundamental traders now arm themselves with quantitative techniques, accounting for $55 billion of systematic assets, according to Barclays. Agnostic to specific companies, quantitative funds trade based on patterns and dynamics across a wide swath of securities. Such quants accounted for about 17 percent of total hedge fund assets, as data compiled by Barclays in 2018 showed.

Point72, with $14 billion in assets, has been shifting about half of its portfolio managers to a human-plus-machine approach. Point72 is also investing tens of millions of dollars into a group that analyzes large amounts of alternative data and passes the results on to traders.

Stefan Jansen, “Machine Learning for Algorithmic Trading: Predictive models to extract signals from market and alternative data for systematic trading strategies with Python”, 2nd Edition, Packt Publishing, Jul 31, 2020.

The Economist

Quantum for quants

Wall Street’s latest shiny new thing: quantum computing

A fundamentally new kind of computing will shake up finance—the question is when

Dec 19th 2020 edition